INP-WealthPk

Hifsa Raja

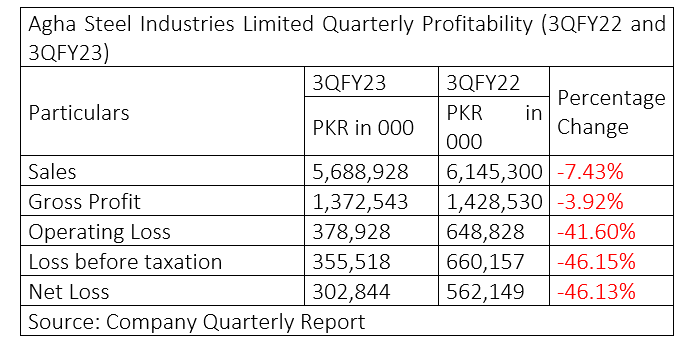

Agha Steel Industries Limited (ASIL) sales decreased 7.43% to Rs5.6 billion in the third quarter (January-March) of the ongoing fiscal year 2022-23 (3QFY23) from Rs6.1 billion over the corresponding period of the previous fiscal. Similarly, the company’s gross profit decreased by 3.92% to Rs1.3 billion in 3QFY23 from Rs1.4 billion in 3QFY22. The company’s operating profit decreased 41.6% to Rs378 million in 3QFY23 from Rs648 million in 3QFY22. The company’s profit-before-tax also decreased 46.1% to Rs355 million from Rs660 million in 3QFY22. The profit-after-tax also plunged 46.13% to Rs302 million in 3QFY23 from Rs562 million in 3QFY22, reports WealthPK.

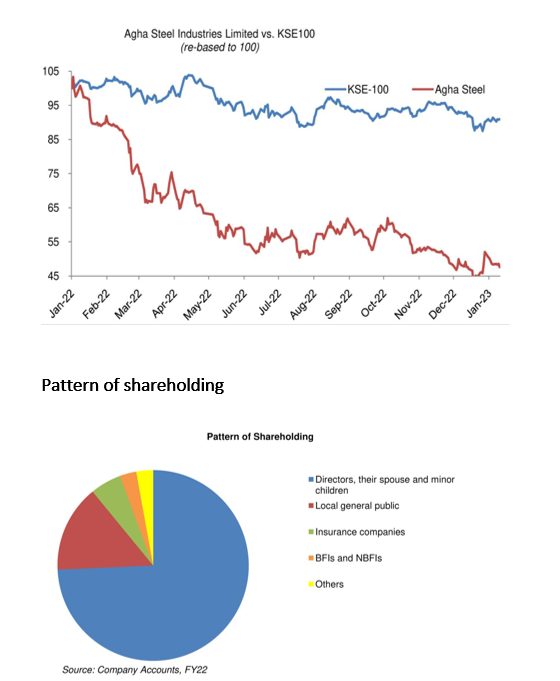

Over 6,000 stockholders held 604.87 million shares of ASIL's existing share capital as of June 30, 2022. Directors, their spouses and children held 74% of the company's total shares. The general public (local) held 14.79% of the shares. Banking and nonbanking financial institutions held 2.77% of the company's shares, followed by insurance firms with 5.29%. Other groups such as Modarabas and mutual funds, and international businesses, owned the remaining shares.

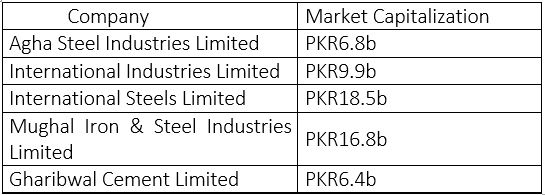

Industry comparison

International Industries Limited, International Steels Limited, Mughal Iron & Steel Industries Limited, Gharibwal Cement Limited are regarded the rivals of Agha Steel Industries Limited in terms of market capitalisation. International Steels Limited has the largest market capitalisation of Rs18.5 billion followed by Mughal Iron & Steel Industries Rs16.8 billion. The market value of Agha Steel Industries Limited is Rs6.8 billion.

Important events

Agha Steel signed a Memorandum of Understanding with Saima Group to execute Pakistan’s first-ever eco-friendly green housing project. Agha Steels also conducted a consultant and structural engineer event, inviting the country’s top consultants and structural engineers to share their experiences on modern construction and the quality of steel required. The company organised an interactive session for the faculty of the Shaheed Zulfiqar Ali Bhutto Institute of Science and Technology (SZABIST).

The SZABIST faculty interacted with the top management of the company, including its chief executive officer Hussain Agha. One of the main objectives of this session was to build academia-industry linkages through corporate involvement in curriculum and to enrich the academia with the knowledge of real-time industry practices.

The firm is listed on the Pakistan Stock Exchange by selling 120,000,000 shares of common stock at par value of Rs10 each, to the general public at a strike price of Rs32 per share plus a premium of Rs22 per share, generating Initial Public Offering proceeds of Rs3.8 billion on Nov 2, 2020. The company plans to bring MiDa technology to its operations for steel rolling. This will help the company export steel.

Company profile

Agha Steel Industries was incorporated on November 19, 2013 as a private limited company. It was converted into a public limited company on April 7, 2015. The company is engaged in manufacturing and sale of steel bars, wire rods and billets.

Credit: Independent News Pakistan-WealthPk