INP-WealthPk

Shams ul Nisa

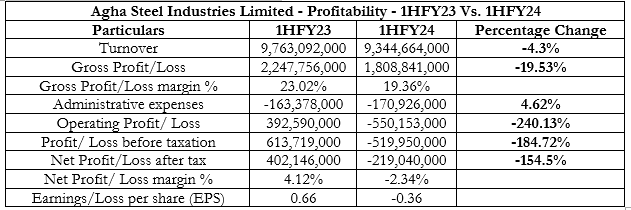

Agha Steel Industries Limited has released its financial statement for the first half of the fiscal year 2024, posting a notable decrease of 4.3% in net turnover and 154.5% in net profit, report WealthPK. The steel company's gross profit for FY23 dropped by 19.53% to Rs1.8 billion from Rs2.24 billion in the same period last year. The primary causes include the surge in inflation, increased energy prices, and persistent growth in commodity prices.

The company's gross profit margin contracted from 23.02% in 1HFY23 to 19.36% in 1HFY24 due to the decline in the company’s activity and a corresponding decrease in the cost of sales. In terms of spending, the company had a 4.62% hike in administrative expenses, with Rs170.9 million in 1HFY24. The steel company's operational profit for 1HFY24 dropped dramatically by 240.13%, registering an operating loss of Rs550.15 million compared to an operating profit of Rs392.59 million in 1HFY23.

The company also suffered a loss before taxes of Rs519.9 million in 1HFY24, down around 184.72% from a profit of Rs613.7 million in the same time the previous year. The steel company's net profit margin thereby dropped from 4.12% in 1HFY23 to a loss margin of 2.34% in 1HFY24. Earnings per share thus decreased from Rs0.66 in 1HFY23 to a loss per share of Rs0.36 in 1HFY24.

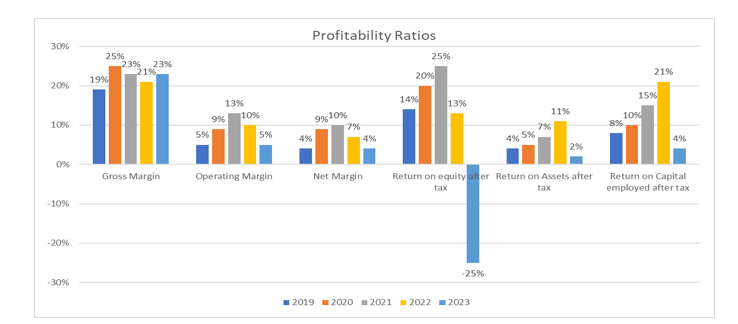

Profitability Ratios Analysis

From 2019 to 2023, Agha Steel Industries' gross margin stayed comparatively steady, ranging from 19% to 25%. In both 2019 and 2023, the operating margin stayed at 5%. Nonetheless, there were variations throughout 2020, 2021, and 2022, with 2021 seeing the greatest operating margin of 13%. Similar trends were seen in the net margin, which varied over the five years, but remained constant at 4% in 2019 and 2023. The year 2021 had the largest net margin ever, at 10%. After taxes, the company's return on equity rose from 14% in 2019 to 25% in 2021, but it then sharply decreased to -25% in 2023. This can be the result of the declining net margin.

Regarding returns on assets after taxes, the steel company had the greatest return of 11% in 2022 and the lowest in 2023 at 2%. Comparably, after taxes, the return on capital employed rose from 8% in 2019 to a peak of 21% in 2022 before falling to 4% in 2023.

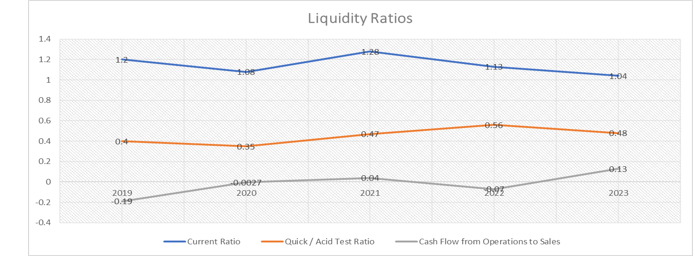

Liquidity Ratios Analysis

The current ratio inspects how effectively a company can cover its short-term commitments with its current assets. A current ratio below 1.2 increases the risk that the company won't be able to meet its short-term obligations, whereas one between 1.2 and 2 and above is regarded as safe. The company’s current ratio varied throughout the years. In 2021, the steel company documented a maximum value of 1.28.

From 2019 to 2023, the quick ratio did not rise over 1, indicating the company's diminished capacity to meet its immediate liabilities. With values of -0.19, -0.0027, and -0.07, the cash flow from operations was negative in 2019, 2020, and 2022. However, values of 004 and 0.13 in 2021 and 2023, stayed positive.

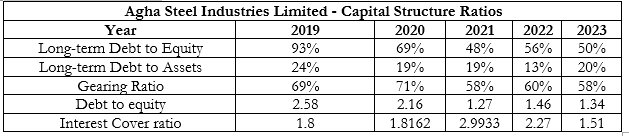

Capital Structure Ratios Analysis

The gearing ratio measures the degree of financing operations of a company by shareholders' funds or equity capital versus creditors' funds or debt financing. A higher gearing ratio indicates greater financial risk for the company, as it has more debt than equity. The company's gearing ratio has increased over time, ranging from 58% to 71%, suggesting that it has taken on more debt than it has paid back to its owners.

A company's debt-to-equity ratio indicates how its assets are financed by borrowing money or by the equity held by its owners. Greater than one implies that the majority of the company's assets are funded by borrowing, while less than one shows that shareholders' equity is used to finance the majority of the company's assets. The debt-to-equity ratio of the steel manufacturing company has been over 1 from 2019 to 2023, suggesting that additional assets are being financed by borrowing.

The interest coverage ratio calculates how profitable the company must be to pay interest on its obligations. A better ability to finance interest payments is indicated by a higher interest cover ratio. If the ratio is less than 1.5, it is deemed hazardous for the company to make interest payments. The interest cover ratio for the steel manufacturing company from 2019 to 2023 was more than 1.5, indicating the company's improved financial standing.

Future Outlook

The company expects the government to act immediately to resolve the current economic crisis, which includes completing the IMF program. It is also expected to create a business-friendly environment for the industrial sector's recovery and sustainability in the future, as any delay will exacerbate the nation's already dire economic circumstances.

Credit: INP-WealthPk