INP-WealthPk

Ayesha Mudassar

The execution of an aggressive yet selective import compression policy has proved effective in shrinking the country’s current account deficit (CAD), said Dr Ashfaque Hassan, Dean of National University of Science and Technology (NUST), Islamabad. Talking to WealthPK, he claimed that he had been requesting the government and the departments concerned adopt the policy of banning import of certain luxury and fast-moving items for the last few years.

He said the policymakers had successfully steered Pakistan towards a path of growth, where the current account was now boosting rather than depleting the country's forex reserves. The NUST dean emphasised the necessity for Pakistan to prioritise import substitution and export expansion to establish a healthy current account. Though the fiscal 2022-23 was a challenging year, it witnessed noteworthy current account balance improvements.

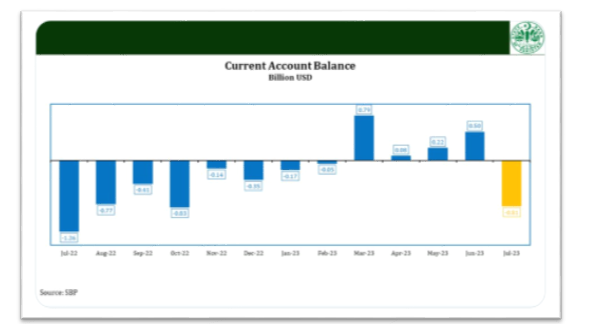

As per the recent data released by the State Bank of Pakistan

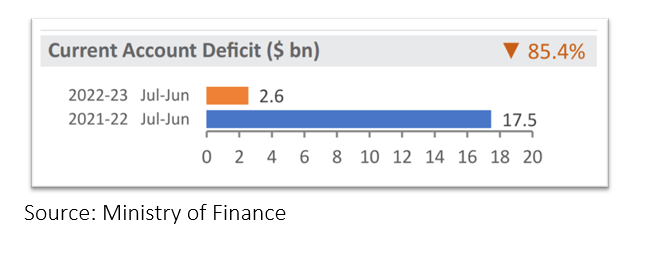

(SBP), CAD was recorded at $0.8 billion in July 2023 compared to a deficit of $1.3 billion in July 2022. Moreover, the current account posted a surplus of $334 million in June 2023 against a deficit of $2.32 billion during the corresponding month last year. According to the monthly Economic Update and Outlook for July 2023, the CAD declined by 85.4% as compared to the last year. The current account posted a deficit of $2.6 billion for FY23 compared to the previous year's massive deficit of $17.5 billion.

The predominant factor behind this improvement was the 27.3% decrease in the merchandise trade deficit on the back of a substantial decline in import payments to $52 billion during FY23 from $71.5 billion the year earlier. “The reduction in imports is mainly due to the government’s decision to impose an import ban to reduce pressure on the foreign exchange reserves,” the secretary finance told a Senate Standing Committee on Finance and Revenue recently. Keeping in view the unfavourable global and domestic economic conditions, the government has taken necessary austerity measures to contain aggregate demand.

As per the Economic Survey 2022-23, those measures include the imposition of a 100 % cash margin requirement on a total of 702 items, tightened regulations on exchange companies, prudential regulation on consumer financing, and increasing Cash Reserve Requirements (CRR) for banks by 100 basis points (bps). Along with the decline in imports, exports also plunged by 14.1% in FY23, recorded at $27.9 billion as compared to $32.5 billion in FY22.

Source: Ministry of Finance

Talking to WealthPK, Lahore Chamber of Commerce and Industry (KCCI) President Kashif Anwar said that numerous factors, including weak global demand, austerity measures (high-interest rates and import controls), and political uncertainty, had negatively impacted the country’s export performance. “The current situation highlights the need for inclusive measures to address the challenges faced by the export sector. Relevant departments must collaborate to find innovative approaches that reduce costs, enhance productivity and improve competitiveness,” he stressed.

Credit: INP-WealthPk