INP-WealthPk

Shamsul Nisa

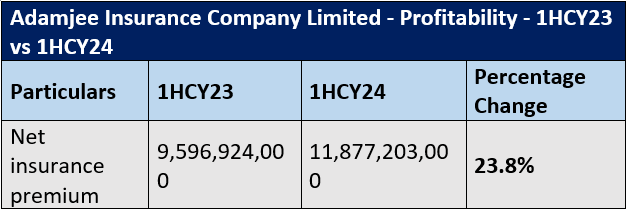

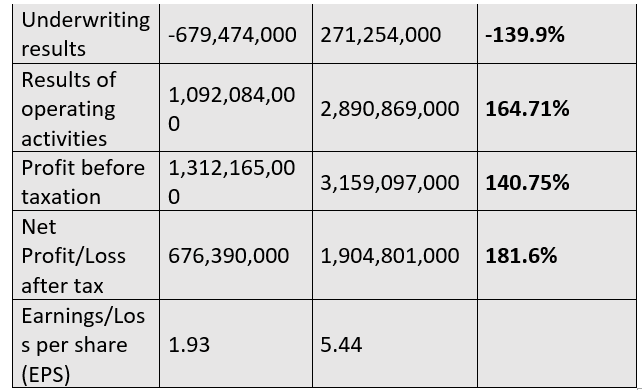

Adamjee Insurance Company Limited’s net profit leapt by a substantial 181.6% in the first half of the ongoing calendar year 2024 compared to the same period of 2023, reports WealthPK.

The company’s net insurance premium increased by 23.8% during the period. Underwriting results showed a remarkable turnaround from a loss of Rs679.47 million in 1HCY23 to a profit of Rs271.25 million in 1HCY24. The company attributed the reduction in losses to its UAE operations during the period.

Operating performance also saw a significant rise of 164.71%, indicating improved operational efficiency and cost management. Due to a 92% hike in investment income and increased underwriting results, profit-before-taxation increased by 140.75%. The earnings per share (EPS) also improved significantly, from Rs1.93 in 1HCY23 to Rs5.44 in 1HCY24, indicating a positive shareholder performance.

Insurance sector

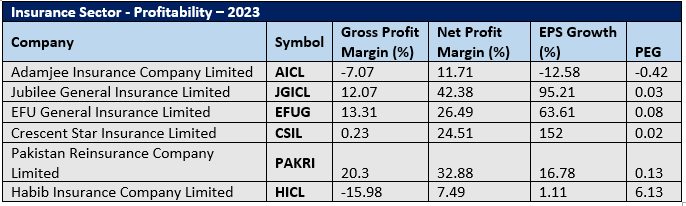

The insurance sector’s performance in 2023 shows mixed results in terms of profitability and growth. Adamjee Insurance struggled with a negative gross profit margin of -7.07% and a low net profit margin of 11.71% in 2023, indicating challenges in covering costs and achieving profitability. Furthermore, the company posted an EPS growth of 12.58% and a negative PEG ratio of -0.42, highlighting the profitability and growth challenges. In contrast, Jubilee General Insurance Limited (JGIL) and EFU General Insurance Limited had positive gross profit margins of 12.07% and 13.31%, respectively, reflecting effective underwriting results. JGIL stood out with a strong net profit margin of 42.38% and an impressive EPS growth rate of 95.21%, indicating excellent operational efficiency and shareholder value enhancement. EFUG also performed well, with an EPS growth rate of 63.61%.

Crescent Star Insurance Limited (CSIL) showed a low gross profit margin of 0.23%, but its strong net profit margin of 24.51% and significant EPS growth of 152% suggest improvements in profitability. Pakistan Reinsurance Company Limited (PAKRI) demonstrated robust financial health with a gross profit margin of 20.3% and a strong net profit margin of 32.88%, showing consistent profitability. Meanwhile, Habib Insurance Company Limited (HICL) faced operational difficulties with a negative gross profit margin of -15.98% and a low net profit margin of 7.49%, a minimal EPS growth, and a high PEG ratio, suggesting overvalued growth prospects.

Balance sheet analysis

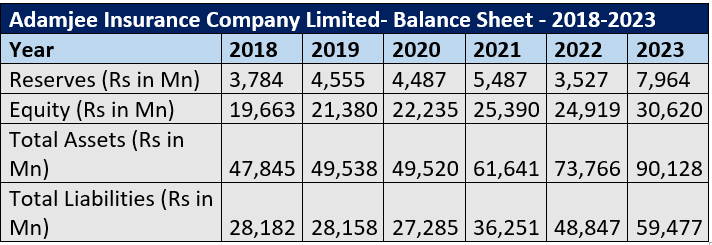

Adamjee Insurance saw its reserves increase from Rs3.78 billion in 2018 to Rs7.96 billion in 2023, showcasing a positive trend in retained earnings and overall financial stability. Similarly, equity has also experienced growth, rising from Rs19.66 billion in 2018 to Rs30.62 billion in 2023, indicating that the company has strengthened its capital base and enhanced shareholder value.

Total assets surged by 88% to Rs90.12 billion in 2023, showing the company’s active investment in operations and potential expansion of its insurance portfolio. Furthermore, total liabilities rose from Rs28.18 billion in 2018 to Rs59.48 billion in 2023.

Future outlook

In FY24, Pakistan’s economy grew by 2.38%, recovering from the difficulties faced in FY23. The government, which successfully completed the IMF’s short-term programme during the period, is now working to control inflation and effect sustainable economic growth through stricter monetary policies. To boost economic activity and improve business confidence, the State Bank of Pakistan has also reduced interest rates.

Company profile

Adamjee Insurance, which was established in Pakistan in 1960, is principally engaged in the general insurance business.

Credit: INP-WealthPk