INP-WealthPk

Shams ul Nisa

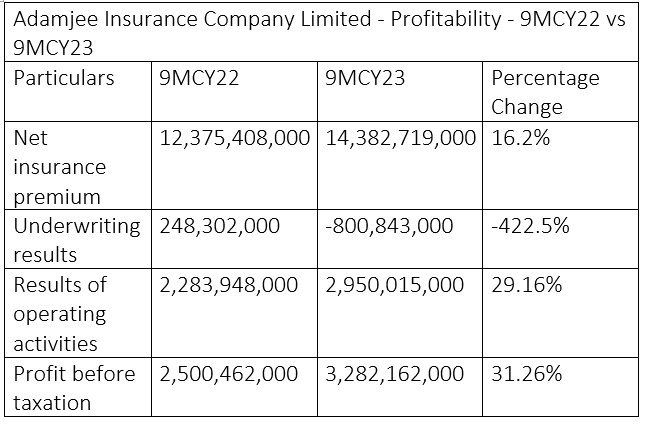

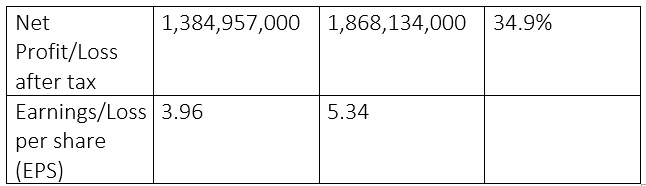

Adamjee Insurance Company Limited saw a significant 23.0% increase in net insurance premium in the first nine months (January-September) of calendar year 2023 compared to the same period of 2022, reports WealthPK. However, the company's underwriting results saw a sharp decline of 422.5%, suffering a loss of Rs800.84 million in 9MCY23 compared to a profit of Rs248.3 million in 9MCY22.

Whereas, the earnings from operations climbed to Rs2.95 billion in 9MCY23, posting a 29.16% rise from Rs2.28 billion in the previous year. The insurance company's profit-before-tax improved by 31.26% to Rs3.28 billion in 9MCY23 from Rs2.5 billion in the same period the previous year. Therefore, there was a 34.9% expansion in the company's net profitability from Rs1.38 billion in 9MCY22 to Rs1.86 billion in 9MCY23. The insurance company's earnings per share stood at Rs5.34 in 9MCY23 compared to Rs3.96 in 9MCY22, indicating the company's improved profitability.

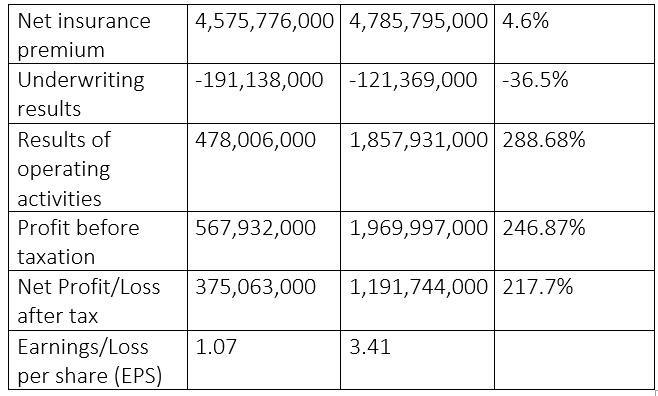

3QCY23 compared with 3QCY22

In 3QCY23, net insurance premiums increased by 4.6% to Rs4.78 billion from Rs4.57 billion in 3QCY22.

The underwriting results in 3QCY23 posted a 36.5% decrease to Rs121.36 million from Rs191.13 million previously. During the period under review, the insurance company's operating activities and profit-before-tax grew by mammoth 288.68% and 246.87%, respectively. In 3QCY23, the net profit increased to Rs1.91 billion, posting a staggering 217.7% growth over the previous year's Rs375.06 million. The EPS increased from Rs1.07 in 3QCY22 to Rs3.41 in 3QCY23.

Liquidity analysis

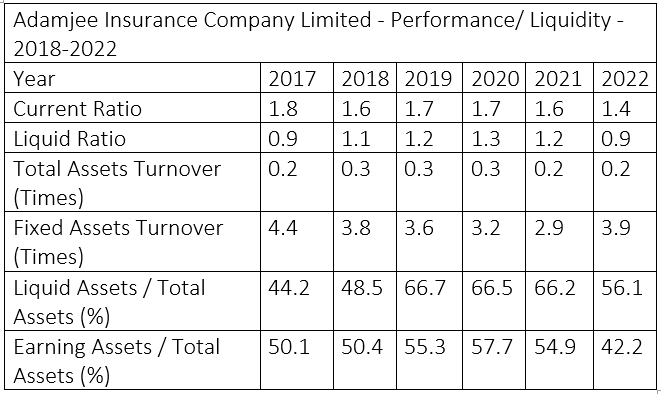

The company's performance and liquidity ratios fluctuated from 2017 to 2022. In 2017, the insurance company's current ratio of 1.8 dropped to 1.4 in 2022. This demonstrates that over the years, the company's capacity to pay short-term liabilities using its current assets decreased. The liquid ratio increased from 2017 to 2020 before declining in 2021 and 2022.

The company's ability to generate revenue from its assets is gauged by the total asset turnover, which stayed largely stable overtime. Nonetheless, the total assets turnover value remained below 1, indicating that the business has not made effective use of its assets to generate income. However, the fixed assets turnover improved to 3.9 in 2022 from 2.9 in 2021, indicating better use of fixed assets to generate income in 2022. Liquid asset to total asset ratio increased from 44.2% in 2017 to a peak of 66.7% in 2019. It progressively decreased in the ensuing years, reaching 56.1% in 2022. On the other hand, the proportion of earning assets to total assets fell from 50.1% in 2017 to 42.2% in 2022.

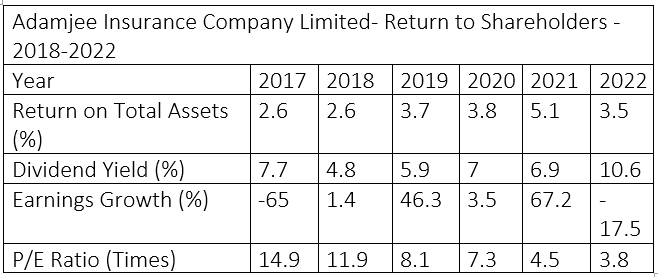

Return to shareholders analysis

In 2022, the insurance company's return on total assets rose to 3.5% from 2.6% in 2017. Whereas, 2021 saw the largest growth, with a 5.1% return on total assets. Similarly, the dividend yield percentage saw an expansion of 10.6% in 2022, the highest growth over the period under review. Nonetheless, the company experienced a negative earnings growth of 65% in 2017 and 17.5% in 2022. The company reported the highest earnings growth of 67.2% in 2021. The price-to-earnings ratio decreased from 14.9 in 2017 to 3.8 in 2022.

Credit: INP-WealthPk