INP-WealthPk

Qudsia Bano

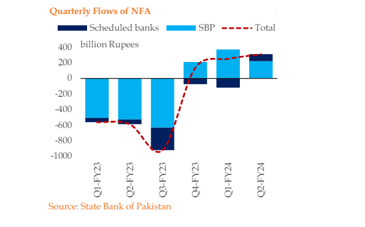

Financial experts are raising concerns over the implications of accelerated broad money growth observed in the first half of the ongoing fiscal year (1HFY24). The surge in broad money, including physical currency and demand deposits, has sparked worries about its long-term impact on Pakistan's fiscal stability. During 1HFY24, broad money (M2) growth surged to 4.5%, a notable increase from the 1.2% recorded during the same period last year. This expansion in money supply was propelled by both Net Domestic Assets (NDA) and Net Foreign Assets (NFA), with the government's heightened reliance on commercial banks for financing the fiscal deficit being a significant driver.

Dr Hamid Haroon, a prominent economist, warns that such rapid growth in broad money poses substantial risks to the country's fiscal health in the long run. "Accelerated money supply growth can lead to inflationary pressures and currency devaluation, eroding the purchasing power of citizens and undermining overall economic stability," he cautioned. The increase in NDA, largely fueled by increased government borrowing from commercial banks, has been a key contributor to the surge in broad money. While external financing, particularly from multilateral institutions like the IMF, has boosted NFA, concerns linger about the sustainability of this reliance on external inflows to support the economy. "Relying heavily on borrowings, both domestic and external, to finance the fiscal deficit can create a debt burden that may become unsustainable over time, hampering economic growth and development," noted Dr Ahmad Mateen, a financial analyst specializing at the World Bank.

He said that the growth in broad money has implications for monetary policy management and financial stability. "The State Bank of Pakistan faces the challenge of balancing the need for liquidity in the banking system with the risks of inflation and exchange rate volatility." Ahmad emphasized the importance of a prudent fiscal policy framework to address these challenges. "Pakistan needs to adopt a comprehensive fiscal strategy that focuses on revenue generation, expenditure prioritization, and debt management to mitigate the risks associated with accelerated broad money growth," he stressed. "While short-term measures such as Open Market Operations (OMOs) can help manage liquidity in the banking system," Ahmad emphasized the need for a holistic approach to fiscal and monetary policy coordination to ensure long-term fiscal sustainability and economic stability.

Credit: INP-WealthPk