INP-WealthPk

Fakiha Tariq

Abbott Laboratories (Pakistan) Limited generated revenue of Rs49 billion in the calendar year 2022, which is the highest of the last five years, and 16% higher than the sales of Rs42 billion posted by the company in 2021, WealthPK reports. Abbott Laboratories (Pakistan) Limited is listed on the Pakistan Stock Exchange with the symbol of ABOT in the pharmaceutical sector. With a market capitalisation of Rs39.2 billion, ABOT is the largest pharmaceutical firm listed on PSX. Incorporated in 1948, ABOT is primarily engaged in manufacturing and selling of generic pharmaceuticals and other products for medical use.

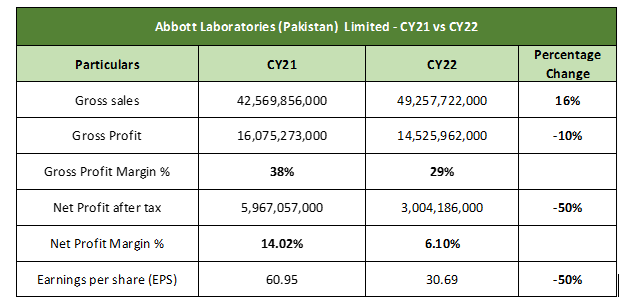

However, in CY22, ABOT’s gross profit decreased 10% in comparison to CY21. The company posted gross profit of Rs14 billion in CY22 compared to Rs16 billion in CY21. Thus, the gross profit ratio moved down from 38% in CY21 to 29% in CY22. With a decrease of 50%, ABOT posted net profit of Rs3 billion in CY22 compared to Rs5.9 billion in CY21. Moreover, ABOT’s earnings per share value decreased to Rs30.69 in CY22 from Rs60.95 in CY21.

ABOT – Historical Analysis – CY18-CY22

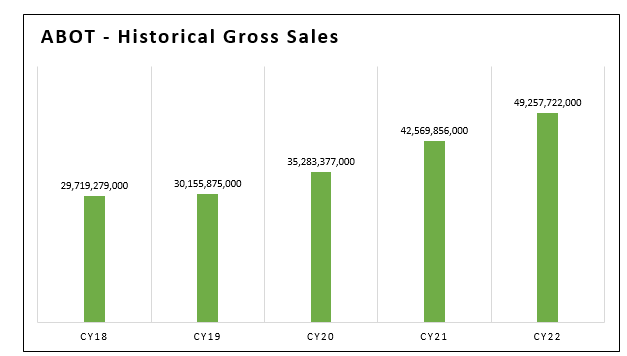

An increasing trend has been witnessed in ABOT’s gross sales during the last five years (from CY18 to CY22). However, the company posted the highest sales of Rs49 billion in CY22 during the last five years.

In the year 2018, ABOT posted gross revenue of Rs29 billion, which inched up to Rs30 billion in CY19. The company posted incremented gross sales of Rs35 billion in CY20 and Rs42 billion in CY21.

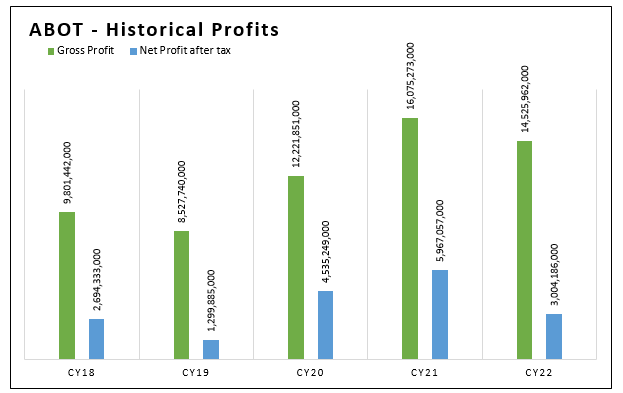

ABOT posted gross and net profits of Rs16 billion and Rs5.9 billion in CY21, which was the highest of last five years. The gross profit earned by ABOT in CY22 was Rs14 billion, but its net profit shrank to Rs3 billion. In terms of profit, CY22 discontinued the increasing trend observed in ABOT profits from CY19 till CY21.

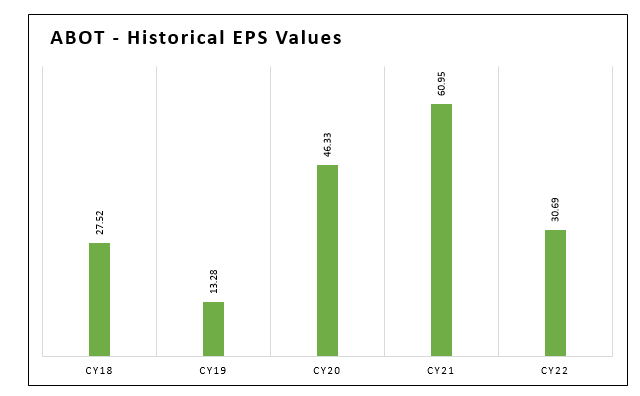

ABOT posted the highest five-year EPS value of Rs60.95 in CY21. In CY22, ABOT posted the third-highest EPS value of last five years, which was Rs30.69. No price trend has been found in ABOT’s EPS values during the last half a decade.

Credit: Independent News Pakistan-WealthPk