INP-WealthPk

Shams ul Nisa

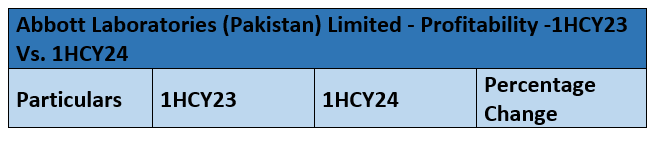

Abbott Laboratories (Pakistan) Limited (ABOT) earned a net profit of Rs2.14 billion in the first half of the ongoing calendar year 2024 compared to a net loss of Rs799.37 million in 1HCY23, representing an impressive growth of 367.7%, reports WealthPK.

Additionally, the company registered an 18.2% increase in net sales, which increased from Rs27.24 billion in 1HCY23 to Rs32.20 billion in 1HCY24, indicating a successful expansion of established brands. Thus, the gross profit improved by 43.67%, resulting in a significant rise in gross profit margin from 21.31% in 1HCY23 to 25.90% in 1HCY24, mainly driven by price adjustments and various other efficiency measures taken across the company. Operating profit also saw a significant growth of 386.71% during the period.

The results show a remarkable expansion of 2,081.41% in profit-before-taxation in 1HCY24. The substantial expansion in net profit caused the company to post a net profit margin of 6.65% in 1HCY24 compared to a loss margin of -2.93% in 1HCY23. The company managed to translate a loss per share of Rs8.17 in 1HCY23 to earnings per share of Rs21.86 in 1HCY24, indicating a positive outlook for shareholders.

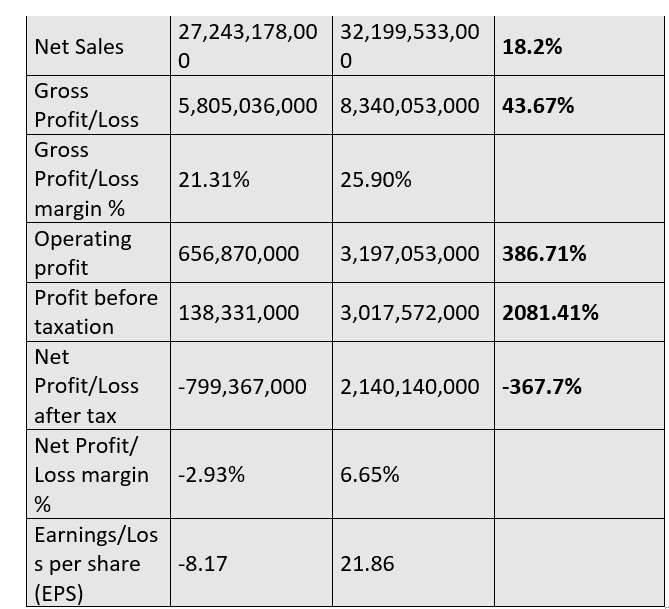

Capital structure ratios (2018-23)

Abbott Laboratories’ interest cover ratio has fluctuated over the years, dropping from 279.34 in 2018 to 48.29 in 2019, but rebounding to 130.7 in 2022 before declining to 86.5 in 2023. This suggests the company’s interest costs increased and operating income declined. The finance leverage ratio decreased significantly from 1.60% in 2018 to 0.90% in 2023 due to a decrease in lease obligation on account of rental payments in 2023 compared to 2022. A lower ratio suggests lower financial risk as it means the company is less vulnerable to interest rate fluctuations and debt obligations.

The debt-to-equity ratio also decreased from 1.30% in 2018 to 0.30% in 2023, indicating a significant decrease in the company’s debt relative to its equity. Lower ratios indicate a stronger equity position and reduced risk associated with debt financing. Net assets per share have steadily risen from Rs135.2 in 2018 to Rs186.3 in 2023, reflecting growth in the company’s asset base and an increase in shareholder value. This consistent upward trend suggests that Abbott Laboratories has been successfully managing its resources and creating value for its shareholders over the years.

Pharmaceuticals sector

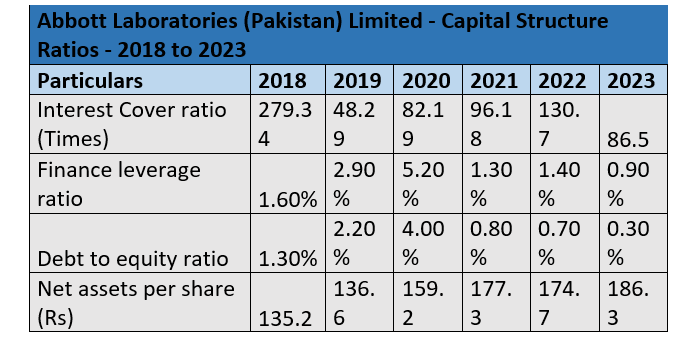

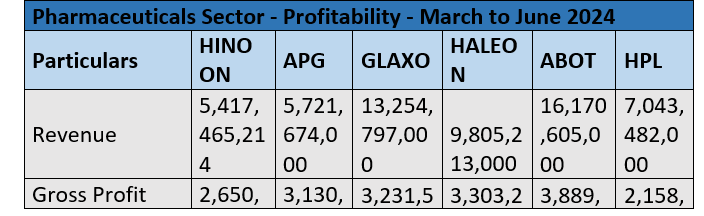

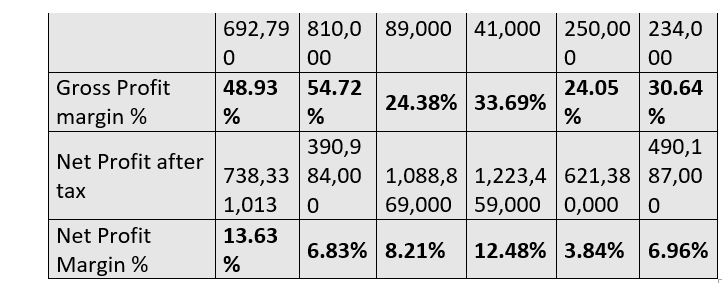

The pharmaceuticals sector generated Rs57.41 billion in revenue and Rs18.3 billion in gross profit from March to June 2024, with profit margins varying between the highest of 54.72% and the lowest of 24.05%. Furthermore, the total net profit for the sector stood at Rs4.55 billion, with margins ranging from 3.84% to 13.63%. ABOT was the highest-performing company in terms of revenue, with Rs16.17 billion in earnings. However, its net profit margin was the lowest among its peers, indicating potential challenges in cost management or pricing power.

Highnoon Laboratories (HINOON) was the highest-performing company in terms of profitability, with a gross profit margin of 48.93% and a net profit margin of 13.63%. GlaxoSmithKline Pakistan Limited (GLAXO) and Haleon Pakistan Limited (HALEON) also performed well, with net profit margins of 8.21% and 12.48%.

Future outlook

The pharmaceutical sector has seen some relief from economic uncertainty due to recent stability in exchange rate and inflation. However, the outlook remains mixed. Sustained economic stability, supportive fiscal policies, and continued review of regulations are crucial for the industry’s sustained operations. The company is aware of these challenges and will continue to strive to mitigate adverse impacts through productivity and cost-containment initiatives.

Company profile

ABOT is a public limited company incorporated in Pakistan on July 2, 1948. The company is principally engaged in manufacturing, importing, and marketing branded generic pharmaceutical, nutritional, diagnostic, diabetes care, molecular devices, and hospital and consumer products.

Credit: INP-WealthPk