INP-WealthPk

Shams ul Nisa

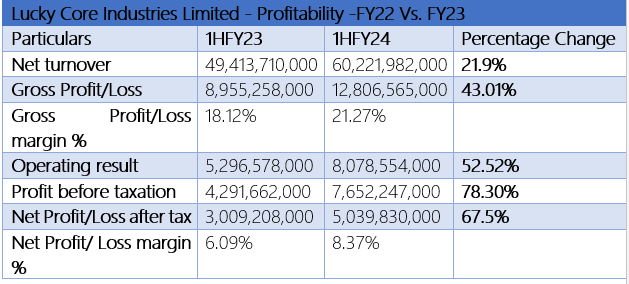

For the first half of the fiscal year 2024, Lucky Core Industries Limited's net turnover stood at Rs60.22 billion, increasing 21.9% compared to Rs49.4 billion in 1HFY23, according to WealthPK. The results were driven by the strong performance of chemical and agri sciences, pharmaceuticals, soda ash, polyester, and animal health businesses. The company's gross profit increased by 43.01% to Rs12.8 billion from Rs8.95 billion in 1HFY23, resulting in an improved profit margin of 21.27% in 1HFY24 from 18.21%. The operating results expanded significantly to Rs8.07 billion in 1HFY24, up by 52.52%.

![]()

The company’s pre-tax profit for 1HFY24 totaled Rs7.6 billion compared to Rs4.29 billion in the same period last year. As a result, the net profit expanded by 67.5% to stand at Rs5.03 billion against Rs3.00 billion in 1HFY23. Thus, the net profit margin moved to 8.37% during the review period from 6.09% in 1HFY23. The strong improvement in financial parameters during the review period translated into a massive swing in earnings per share to Rs54.57 compared to Rs32.58 in 1HFY23.

Quarterly analysis

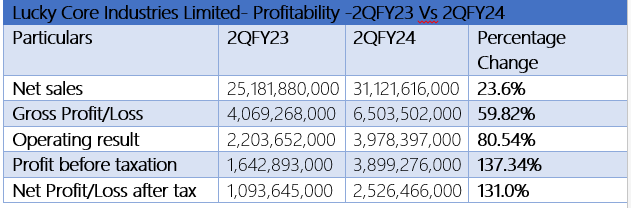

At the end of the second quarter of Fiscal Year 2024, the company witnessed a hefty upward swing in net sales, gross profit, and net profit. A growth of 23.6% was registered in net sales and 59.82% in gross profit during 2QFY24. The results were driven by additional volumes and cost-push price adjustments across all businesses because of higher inflation and currency devaluation.

![]()

Moreover, the operating results grew by 80.54%, reaching Rs3.89 billion in 2QFY24 from Rs2.2 billion in the same period last year. The company attributed this growth to the robust performance of all segments such as polyester, chemicals, agri sciences, pharmaceuticals, soda ash, and animal health business. Similarly, profit before tax showed a tremendous growth of 137.34%, climbing to Rs3.89 billion in 2QFY24. Furthermore, the net profit surged to Rs2.52 billion, up by 131.90% in 2QFY24. Along with the results, the company announced a significant improvement in earnings per share from Rs11.84 in 2QFY23 to Rs27.35 in 2QFY24.

Profitability ratios analysis

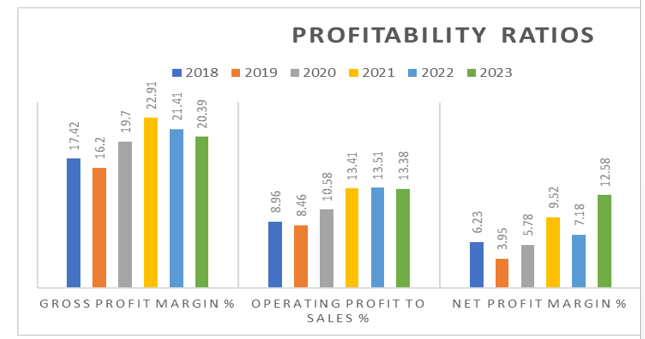

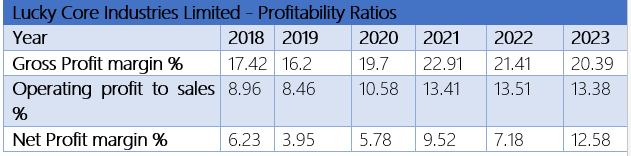

The historical trend of the company’s profitability ratios showed an increasing trend over the past six years with fluctuations in between. Starting from a 17.42% gross profit margin in 2018, the company faced a dip to 16.2% in 2019. However, it increased from the year 2020, with a gross profit margin of 19.7% to the highest of 22.91% in 2021. Furthermore, the gross profit margin stood at 20.39% in 2023.

The operating profit followed a similar pattern, with 8.96% in 2018 to 13.28% in 2023. The company recorded the highest operating profit of 13.51% in 2022. However, the net profit witnessed two dips to 3.95% in 2019 and 7.18% in 2022. Overall, the net profit margin doubled from 6.23% in 2018 to 12.58% in 2023.

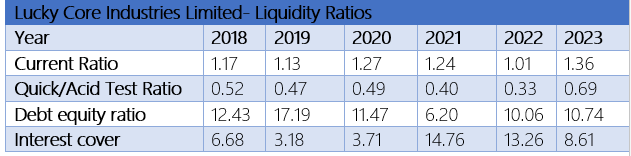

Liquidity ratios analysis

The liquidity ratio offers comprehensive information about a company's ability to pay its debt. The current ratio is used to determine the company's ability to pay off its short-term liabilities. If the current ratio drops below 1.2, the company is more likely to be unable to meet its financial obligations. The company’s current ratio remained stagnant over the past six years ranging between 1.01 in 2022 and 1.36 in 2023, indicating improved current assets. However, the quick ratio remained below 1 from 2018 to 2023, with the value of 0.52 and 0.69 respectively. This reflects that the company has lower quick assets to cover its short-term liabilities.

In terms of debt-to-equity ratio, the company has ample equity to meet its debt. The company’s debt-to-equity ratio remained above 1 from 2018 to 2023, ranging between 6.20 in 2021 to 12.43 in 2018. Likewise, the interest cover ratio remained above 1, showcasing sufficient current company earnings to finance debt. The company posted the highest interest cover of 14.76 in 2021 and the lowest of 3.18 in 2019.

Future outlook

The global growth outlook is uncertain due to various crises, including slowing growth, inflationary pressures, and geopolitical conflicts, resulting in volatility in commodity prices. Pakistan's GDP growth is projected at 2% in 2024, but challenges include inflation, currency depreciation, and high sovereign debt. The country's strategy of curtailing imports through demand control is expected to continue. The economic outlook will be shaped by reforms, political stability, and assistance from friendly nations. This may cause inflationary pressure on goods as well as on the company’s products. The company aimed to leverage its diverse product portfolio, with cost-effective strategies to minimize any adverse impacts and deliver sustainable results.

Company profile

Lucky Core Industries Limited is a public company engaged in five diverse businesses that are polyester, soda ash, chemicals and agri sciences, pharmaceuticals, and animal health. The company manufactures and trades its products including polyester staple fiber (PSF), soda ash, general and specialty chemicals, pharmaceuticals, nutraceuticals, animal health products, and agricultural products.

INPCredit: INP-WealthPk