i INP-WEALTHPK

Shams ul Nisa

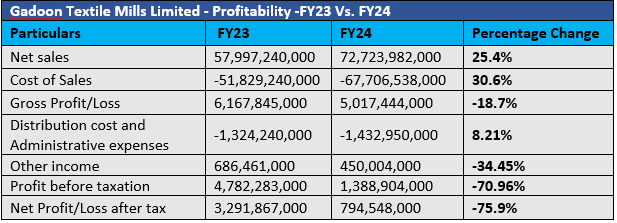

Gadoon Textile Mills Limited (GTML) recorded the highest-ever revenue of Rs72.72 billion during the last fiscal year 2023-24, posting a 25.4% increase from the earlier fiscal. This surge in revenue was mainly driven by increase in sales volume and price, reports WealthPK.

In FY24, Pakistan’s cotton production reached Rs8.397 million bales, bolstering the textile industry and contributing to saving and foreign exchange earnings.

![]()

The sharp rise in energy prices and financing costs drove a 30.6% increase in the cost of sales, leading to an 18.7% drop in gross profit. Additionally, the distribution and administrative expenses rose by 8.21%, while other income fell by 34.45%. Similarly, the profit-before-taxation plummeted by 70.96% in FY24. The net profit plunged by 75.9%, resulting in a significant contraction in the earnings per share, which crashed to Rs28.35 in FY24 from Rs117.44 in FY23.

Textile spinning sector

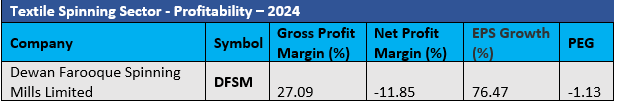

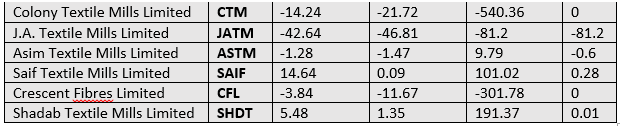

The profitability analysis of the textile spinning sector in FY24 shows mixed performance among companies. Saif Textile Mills Limited posted strong results with a gross profit margin of 14.64% and a modest net profit margin of 0.09%, suggesting effective strategies to enhance profitability and shareholder value. The company posted a remarkable earning per share growth (EPS) of 101.02%, and price-earnings-growth (PEG) of 0.28 in FY24. Shadab Textile Mills Limited posted a gross profit margin of 5.48% and a net profit margin of 1.35% during FY24. Furthermore, it recorded an EPS growth of 191.37% and PEG of 0.01.

Dewan Farooque Spinning Mills Limited showed strong gross margin of 27.09%, but struggled with net profit margin, EPS growth and PEG. Likewise, Colony Textile Mills Limited and JA Textile Mills Limited showed poor performance with gross loss margins of 14.24% and 42.64%, and net loss margins of 21.72% and 46.81%, respectively, in FY24. Similarly, Asim Textile Mills Limited and Crescent Fibres Limited also reported negative margins, indicating ongoing challenges in maintaining profitability amidst rising costs.

Ratios analysis

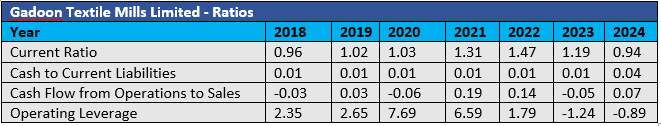

GTML's financial ratios from 2018 to 2024 show significant fluctuations in liquidity, operational efficiency and financial stability. The current ratio grew from 0.96 in 2018 to 1.47 in 2022, but decreased to 0.94 in 2024, indicating growing liquidity issues.

The cash to current liabilities ratio remained low and stagnant at 0.01 from 2018 to 2023, but grew slightly to 0.04 in 2024, showing insufficient cash reserves to cover current liabilities. The cash flow from operations to sales ratio fluctuated, moving from negative 0.03 in 2018 to positive 0.07 in 2024, suggesting a recovery in operational efficiency and profitability. The company witnessed the highest cash flow from operations to sales ratio of 0.19 in 2021. The operating leverage ratio has also shown dramatic changes, starting from 2.35 in 2018 to a peak of 7.69 in 2020 and declining sharply to -0.89 by 2024.

Future outlook

The company is committed to fostering innovation in the industry by diversifying into value-added sectors and expanding its value chain. The company anticipates a downward trend in inflation and interest rates and no significant movement in power tariffs. The IMF’s $7 billion Extended Fund Facility is expected to alleviate pressure on foreign exchange reserves, creating a more favourable environment for growth and investment. The company's management is confident that substantial capital investments will give it a competitive advantage. However, high finance and energy costs will continue to pressure profit margins. The company has allocated a budget for developing resource capitals, including human, manufactured, intellectual, social and relationship capital.

Company profile

GTML was established as a public limited company in Pakistan on February 23, 1988. The company's main operations include the manufacturing and selling of yarn and knitted bedding products. The firm also runs dairy business, keeping a herd of 1,300 animals. GTML’s holding company is YB Holdings (Private) Limited.

Credit: INP-WealthPk