INP-WealthPk

Ayesha Mudassar

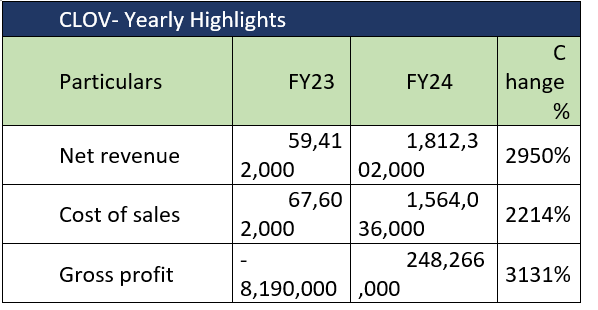

Clover Pakistan Limited (CLOV) reported a net profit of Rs192.3 million for the last fiscal year 2023-24, posting a significant turnaround

from the net loss of Rs71.2 million reported in FY23, reports WealthPK.

The impressive performance highlights the effectiveness of the company’s strategic initiatives and the steadfast commitment of its team in successfully navigating challenging circumstances.

CLOV reported a substantial year-on-year (YoY) increase of 2,950% in its top line, which rocketed to Rs1.8 billion from Rs59.4 million in FY23. The company also managed to shed gross losses in FY23 and posted a robust gross profit in FY24. In addition, the income statement reflected a significant rise in other operating expenses, which increased by 805% YoY. A key milestone for the company was the strategic partnership with Fossil Energy (Private) Limited. This collaboration involves the management, operation and maintenance of Fossil Energy’s Company Owned Company Operated (COCO) filling/service stations, including agri sites. This strategic alliance underscores Clover Pakistan's commitment to diversifying its product portfolio and expanding its customer base, which is vital for fostering sustainable long-term growth.

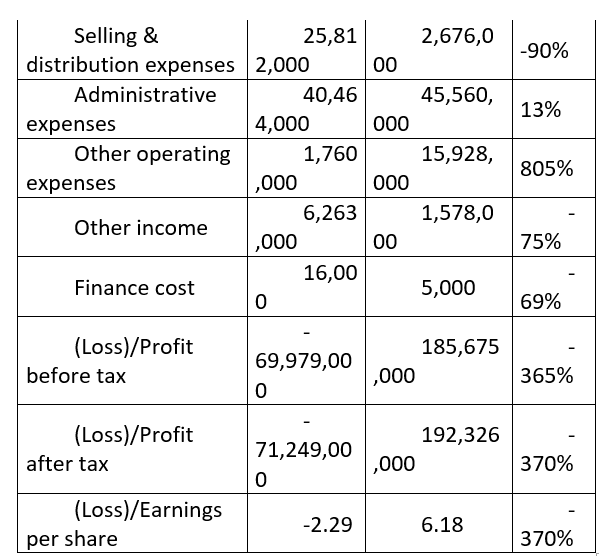

Performance over 2020-23 period

The company has experienced a consistent decline in top line over the years. In addition, CLOV has not recorded any positive bottom-line figures since 2019 and posted the highest net loss in 2021. In 2021, CLOV's revenue fell by 5% YoY as the company implemented a strategic streamlining of its operations. The closure of two marts – Nishat and Sahar Mart – with the declined sale of lubricants resulted in a gross loss of Rs24.07 million for the year. Furthermore, the net loss surged by 290% YoY in 2021, with a loss per share of Rs19.43.

In 2022, CLOV faced its greatest YoY revenue decline of 75% primarily due to reduced sales of industrial chemicals, equipment and lubricants. This sharp downturn was attributed to high inflation, currency depreciation and political uncertainty. Besides, a notable reduction in expenses led to an 82% YoY decrease in net loss, with a loss per share of Rs3.36. The revenue decline continued in 2023 with CLOV’s top line contracting by an additional 21% YoY amid ongoing economic challenges. Nevertheless, operating expenses were successfully reduced by 64% YoY due to rightsizing of resources. Conversely, other income considerably grew by over 11 times in FY23 on account of the high discount rate, which magnified the profit on deposit accounts.

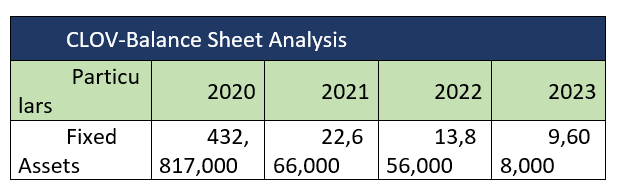

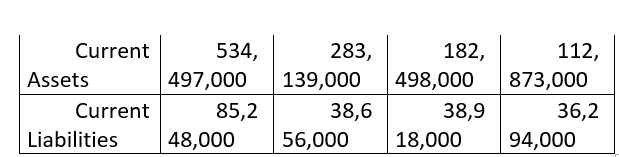

Financial position over 2020-23 period

The analysis of the company’s financial position reveals a dramatic decline in both total assets and current liabilities over the years. In particular, 2022 marked the most significant contraction, with the non-current assets decreasing by 94% and current assets declining by 47%. Furthermore, the current liabilities experienced a notable reduction, falling from Rs85.2 million in 2020 to Rs36.2 million in 2023.

Overall, the trend reflects a significant decline in both fixed and current assets, which may raise concerns about the company’s financial stability and operational efficiency. However, the reduction in current liabilities signifies effective management of short-term obligations, potentially mitigating some of the risks associated with the declining asset base.

About the company

CLOV was incorporated in Pakistan as a publicly listed company in 1986. The company specialises in the sale of consumer durables, food items, chemicals, and lubricants as well as the trade of gantry equipment, air/oil filters, and various car care products. Additionally, CLOV sells, distributes and provides after-sale support for digital screens, gasoline dispensers, vending machines, and office automation equipment.

Credit: INP-WealthPk